|

Getting your Trinity Audio player ready...

|

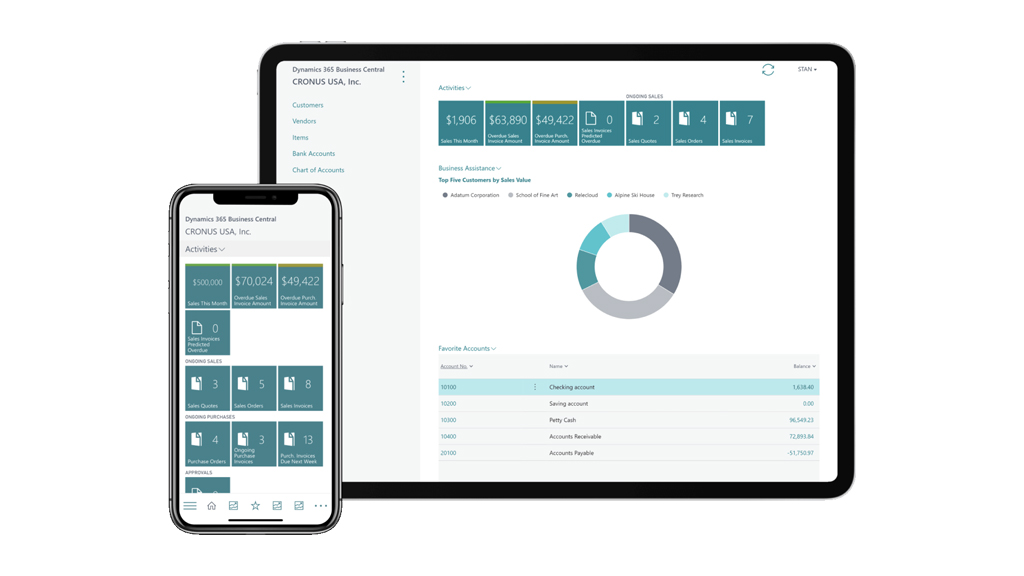

Managing Tariffs and Landed Costs with Dynamics 365 Business Central

Introduction

Tariffs and import-related charges have become a critical cost driver for U.S. businesses operating in global supply chains. What was once treated as an operational expense now plays a major role in pricing strategy, inventory valuation, and profitability.

As trade regulations evolve and customs scrutiny increases, businesses face rising duties, higher logistics costs, and greater financial risk if landed costs are not tracked accurately. For organizations using Microsoft Dynamics 365 Business Central, the challenge is not just recording these expenses—but ensuring they are allocated correctly and reflected across inventory, finance, and reporting.

This blog explains how Dynamics 365 Business Central helps businesses manage tariffs and landed costs effectively, maintain cost transparency, and make informed sourcing and pricing decisions

Understanding Tariffs and Landed Costs

What Are Tariffs?

Tariffs are taxes imposed on imported goods by government authorities. In the U.S., tariff rates vary based on:

-

Product classification (HS code)

-

Country of origin

-

Applicable trade agreements or restrictions

Tariffs directly impact the final cost of imported goods and can significantly affect margins if not planned for properly.

What Are Landed Costs?

Landed cost represents the complete cost of acquiring goods, from supplier to warehouse. It includes:

-

Purchase price

-

Freight and logistics expenses

-

Insurance

-

Customs duties and tariffs

-

Port, handling, and clearance fees

-

Other import-related charges

Without an accurate landed cost calculation, businesses risk mispricing products and misreporting inventory values.

Why Landed Cost Accuracy Is Essential

For U.S. importers, distributors, and manufacturers, accurate landed cost management is not optional—it is essential.

Key Business Impacts

-

Pricing Accuracy: Ensures selling prices reflect true costs

-

Margin Protection: Prevents hidden costs from eroding profits

-

Inventory Valuation: Keeps balance sheets and COGS accurate

-

Compliance: Supports customs documentation and audits

-

Supplier Evaluation: Enables sourcing decisions based on total cost, not unit price

Dynamics 365 Business Central provides a structured way to manage these requirements within a single ERP system.

How Dynamics 365 Business Central Handles Landed Costs

Item Charges for Import-Related Costs

Business Central allows businesses to apply additional costs—such as freight, tariffs, and customs fees—using Item Charges. These charges can be posted after goods are received and allocated accurately across inventory.

Flexible Cost Allocation

Landed costs can be distributed using multiple methods, including:

-

By quantity

-

By value

-

By weight or volume

-

Manually, when required

This flexibility is especially useful for consolidated shipments or mixed-item imports.

Purchase and Invoice Integration

Businesses can:

-

Estimate landed costs at the purchase order stage

-

Record actual costs when vendor invoices are received

-

Adjust variances between estimated and actual charges

This ensures real-world costs are reflected in inventory and financial records

Inventory Valuation and Financial Impact

Once landed costs are posted in Business Central:

-

Inventory values are automatically updated

-

Cost of goods sold reflects true acquisition cost

-

Financial statements provide accurate margin insights

This level of accuracy supports better forecasting, budgeting, and profitability analysis.

Managing Import Duties and Customs Charges

HS Code Tracking

Business Central supports product classification using HS codes, which helps:

-

Apply correct tariff rates

-

Reduce customs delays

-

Improve regulatory compliance

Duty Drawback Tracking

For businesses that import goods and later export them, Business Central helps track duties paid and supports documentation required for duty drawback claims.

Reporting and Visibility

Built-in reports provide insights into:

-

Landed cost breakdowns

-

Tariff impact on margins

-

Inventory cost trends

Supporting U.S. Trade and Financial Compliance

Dynamics 365 Business Central includes features designed for U.S. regulatory requirements, including:

-

Vendor reporting and 1099 support

-

Sales and use tax configuration

-

Role-based security and audit trails

-

Secure cloud infrastructure aligned with U.S. data regulations

These capabilities help businesses stay compliant while maintaining operational efficiency.

How Manufacturers Use Business Central for Imported Materials

Manufacturers importing raw materials rely on Business Central to ensure production costs are accurate.

Practical Example

Imported raw materials are received with freight and duty costs applied as item charges. These costs:

-

Increase raw material inventory value

-

Flow into production orders

-

Are reflected in finished goods costing

This ensures pricing and margin calculations are based on real costs, not estimates.

Gain Better Control with Brightpoint Infotech

Tariffs, duties, and landed costs can quickly become unmanageable without the right ERP setup. Dynamics 365 Business Central provides the tools—but expert configuration makes the difference.

Brightpoint Infotech helps businesses:

-

Configure landed cost and item charge structures

-

Automate cost allocation across inventory

-

Improve pricing and margin visibility

-

Align ERP processes with U.S. trade regulations

-

Optimize Business Central for import-driven operations

Whether you are a distributor, importer, or manufacturer, our Dynamics 365 experts help you turn complex cost structures into clear, actionable insights.

Talk to Brightpoint Infotech today to optimize landed cost management in Dynamics 365 Business Central and protect your margins with confidence.

Conclusion

Tariffs and landed costs are no longer secondary considerations for U.S. businesses operating in global supply chains. With rising import duties, increased regulatory scrutiny, and tightening margins, accurately understanding the true cost of goods has become essential for sustainable growth.

Microsoft Dynamics 365 Business Central provides the visibility and control businesses need to manage tariffs, allocate landed costs accurately, and maintain reliable inventory valuation. When configured correctly, it helps organizations make informed pricing decisions, protect profit margins, and remain compliant with U.S. trade regulations.

However, the real value of Business Central lies in how well it is implemented and aligned with your operational needs. With the right setup, businesses can turn complex import costs into clear, actionable insights.

At Brightpoint Infotech, we help organizations maximize the value of Dynamics 365 Business Central by optimizing landed cost management, improving cost transparency, and supporting long-term profitability. If your business is looking to gain better control over import costs and strengthen financial accuracy, our experts are ready to help.

Explore Brightpoint Infotech Solutions

Explore Our Recent Blogs & Resources

Whether you are a start-up, an SMB, or an enterprise, the Brightpoint Infotech blog is the best place to get inspired and learn more about Microsoft Business Applications.