Simplifying Global Payroll with Dynamics 365 Business Central: A Practical Guide for Modern Businesses

Introduction

Payroll is one of the most fundamental business functions, yet it is often one of the most complicated. Paying employees accurately and on time is only part of the responsibility. Organizations must also manage compliance with labor laws, tax regulations, reporting requirements, and financial controls — all of which become increasingly complex as businesses expand across regions.

For organizations operating in countries such as the United States, Canada, the UAE, and across Africa, payroll complexity multiplies. Different currencies, statutory deductions, tax structures, employment laws, and reporting timelines make payroll difficult to standardize. When payroll systems operate separately from finance and HR, inefficiencies and risks quickly follow.

This is why many organizations are rethinking payroll not as a standalone process, but as a critical component of their overall enterprise system. Microsoft Dynamics 365 Business Central has emerged as a powerful ERP platform that enables this shift by providing a unified foundation for finance, operations, and integrated payroll solutions.

The Changing Nature of Payroll in a Global Economy

In the past, payroll systems were often localized and manual. As long as employees were paid correctly, organizations gave little attention to how payroll data connected with the rest of the business. Today, that approach no longer works.

Modern businesses require real-time insight into workforce costs, cash flow impact, and compliance exposure. Leadership teams need accurate payroll data to support budgeting, forecasting, and strategic planning. At the same time, employees expect transparency, self-service access, and timely payments regardless of location.

Globalization has accelerated this shift. Companies now hire talent across borders, expand into new markets faster, and operate with distributed teams. Payroll must support this reality while remaining compliant with local regulations — a balance that is difficult to achieve without a strong ERP backbone.

Why Disconnected Payroll Systems Create Risk

Many organizations still rely on multiple payroll tools across regions, often supplemented by spreadsheets and manual adjustments. While this may work in the short term, it introduces several long-term risks.

Data duplication is one of the most common issues. Payroll information must be entered separately into HR systems, payroll software, and financial systems. This increases the likelihood of errors and inconsistencies, particularly during month-end and year-end reporting.

Another challenge is delayed visibility. When payroll data is not integrated with finance, leadership teams often see labor costs weeks after payroll has been processed. This delay limits the ability to manage expenses proactively and creates challenges during audits.

Compliance is also harder to manage in fragmented environments. Regulations change frequently, especially in regions with complex tax structures or labor laws. Without centralized control and standardized processes, organizations are more vulnerable to compliance gaps and penalties.

Dynamics 365 Business Central as the ERP Foundation

Microsoft Dynamics 365 Business Central is designed to address these challenges by providing a single, cloud-based ERP platform that connects core business processes. It supports multi-entity operations, multiple currencies, and region-specific configurations — making it well suited for global organizations.

From a payroll perspective, Business Central plays a critical role as the system of record for financial data. When payroll integrates with Business Central, salary expenses, taxes, benefits, and accruals are automatically reflected in the general ledger. This eliminates manual postings and ensures financial data remains accurate and up to date.

The platform also supports strong security controls, ensuring sensitive payroll information is accessible only to authorized users. Combined with audit trails and reporting capabilities, this creates a more controlled and transparent payroll environment.

The Importance of Localization in Global Payroll

While a centralized ERP is essential, payroll cannot be managed with a one-size-fits-all approach. Each country has unique requirements that must be respected.

In the United States and Canada, payroll involves complex federal, state or provincial, and local tax calculations, along with benefits administration and regulatory reporting. In the UAE, organizations must manage End-of-Service Benefits, gratuity calculations, and Wage Protection System (WPS) compliance. Across African countries, payroll requirements vary widely, with country-specific statutory deductions, reporting formats, and labor laws.

Effective payroll solutions built on Dynamics 365 recognize these differences. They allow organizations to localize payroll rules while maintaining a unified data structure within the ERP. This ensures compliance at the local level without sacrificing global visibility and control.

Integrating HR, Payroll, and Finance

Payroll does not exist in isolation. It depends on accurate employee data from HR and directly impacts financial outcomes. When these functions operate in silos, inefficiencies and errors are inevitable.

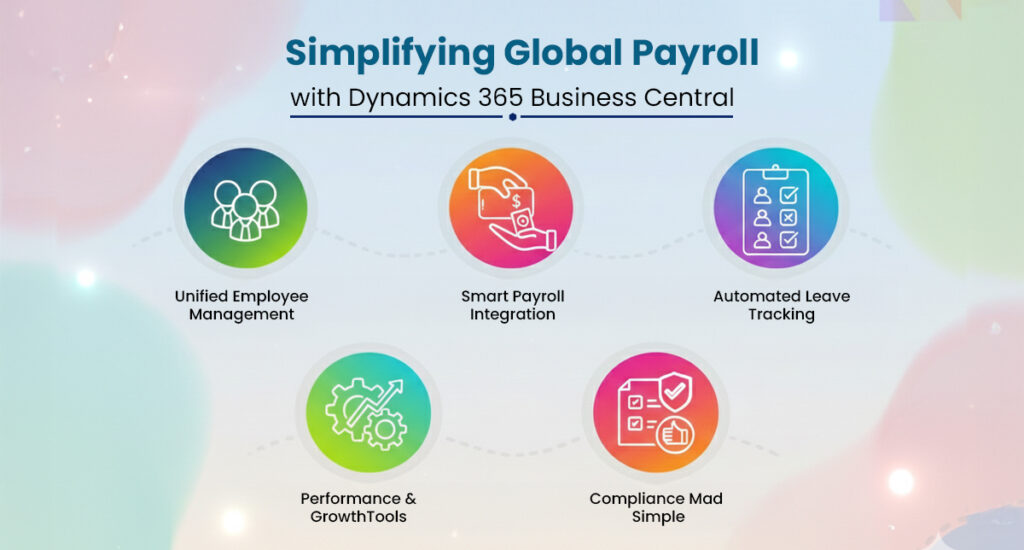

An integrated Dynamics 365 environment enables HR, payroll, and finance to work together seamlessly. Employee onboarding, role changes, leave management, and time tracking all feed into payroll automatically. Payroll results then flow directly into finance, supporting real-time reporting and analysis.

This level of integration reduces administrative effort and allows teams to focus on higher-value tasks such as workforce planning, compliance strategy, and employee engagement.

The Role of Automation in Payroll Accuracy

Automation is one of the most significant benefits of integrating payroll with Business Central. Automated calculations reduce dependency on manual adjustments, which are often the source of payroll errors.

Automation also supports consistency. Payroll rules are applied uniformly across employees and pay cycles, ensuring fairness and accuracy. This is particularly important for organizations managing multiple pay structures, including hourly, salaried, and contract employees.

In addition, automation improves payroll timelines. Faster processing means payroll teams can meet deadlines more easily and respond quickly to changes such as bonuses, retroactive adjustments, or regulatory updates.

Payroll Data as a Strategic Asset

When payroll is integrated into an ERP system, it becomes more than an operational function — it becomes a source of strategic insight.

Organizations can analyze payroll data by department, region, or project to understand cost drivers and trends. This insight supports better decision-making around hiring, expansion, and cost optimization.

For finance leaders, having payroll data available in real time improves forecasting accuracy and cash flow planning. For HR teams, it supports workforce analytics and employee retention strategies. For executives, it provides a clearer picture of the organization’s overall financial health.

Scalability for Growing Organizations

Growth often exposes weaknesses in payroll systems. As organizations add employees, entities, or countries, payroll complexity increases rapidly. Systems that worked for a small workforce may struggle to scale.

Dynamics 365 Business Central provides the flexibility needed to support growth. New entities and regions can be added without rebuilding the entire system. Payroll integrations can be extended to support additional countries while maintaining consistent financial reporting.

This scalability is particularly important for organizations planning regional or international expansion. Having a future-ready payroll and ERP foundation reduces risk and supports smoother growth.

Compliance in an Evolving Regulatory Landscape

Payroll compliance is not static. Regulations evolve frequently, and organizations must adapt quickly to remain compliant. This includes changes to tax rates, reporting requirements, and labor laws.

Payroll solutions that integrate with Dynamics 365 can be updated to reflect regulatory changes while maintaining alignment with financial systems. This reduces the burden on payroll teams and minimizes compliance risk.

Audit readiness also improves when payroll data is centralized and well-documented. Clear audit trails, consistent reporting, and secure data access make compliance reviews more manageable.

Choosing the Right Payroll Strategy

Implementing payroll within an ERP environment requires careful planning. Organizations must evaluate their regional requirements, workforce structure, and long-term goals. The right strategy balances standardization with localization and prioritizes integration over standalone tools.

Equally important is choosing an implementation partner with experience across regions and industries. Understanding both Dynamics 365 capabilities and local payroll requirements is essential to building a solution that works in practice, not just in theory.

Looking Ahead: The Future of Payroll

As technology continues to evolve, payroll will become even more integrated with analytics, automation, and employee experience platforms. Artificial intelligence, predictive insights, and self-service capabilities will further transform how organizations manage payroll.

Dynamics 365 Business Central provides a strong foundation for this future by enabling organizations to adapt and innovate without replacing core systems. Payroll solutions built on this platform are well positioned to evolve alongside business needs.

Final Thoughts

Payroll is no longer just an administrative task. It is a critical business process that impacts compliance, financial accuracy, employee satisfaction, and strategic decision-making. For organizations operating across regions such as the USA, Canada, UAE, and Africa, an integrated and scalable approach is essential.

By leveraging Microsoft Dynamics 365 Business Central as the ERP backbone and adopting localized payroll solutions that integrate seamlessly, organizations can simplify payroll operations while gaining real-time insight and control.

For readers exploring Dynamics 365-based HR and payroll solutions, the informational resources and solution overviews available on the Brightpoint Infotech website provide additional insight into how global payroll can be aligned with modern ERP strategies.

Explore Brightpoint Infotech Solutions

Explore Our Recent Blogs & Resources

Whether you are a start-up, an SMB, or an enterprise, the Brightpoint Infotech blog is the best place to get inspired and learn more about Microsoft Business Applications.